Essay

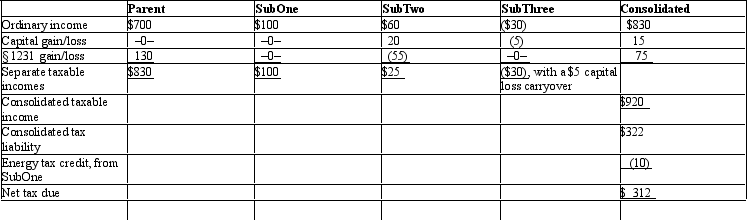

The Parent consolidated group reports the following results for the tax year. Determine each member's share of the consolidated tax liability, assuming that the members all have consented to use the relative tax liability tax-sharing method. Dollar amounts are listed in millions, and a 35% marginal income tax rate applies.

Correct Answer:

Verified

Consolidated tax lia...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q9: The rules can limit the net operating

Q64: When a subsidiary sells to the parent

Q89: ParentCo acquired all of the stock of

Q90: Where are the controlling Federal income tax

Q96: The Philstrom consolidated group reported the following

Q99: The Philstrom consolidated group reported the following

Q110: In computing consolidated taxable income, the profit/loss

Q113: All members of an affiliated group have

Q117: In computing consolidated taxable income, the domestic

Q130: The losses of a consolidated group member