Multiple Choice

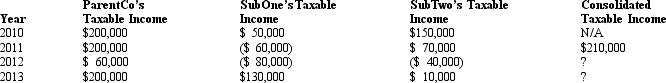

ParentCo, SubOne and SubTwo have filed consolidated returns since 2011. All of the entities were incorporated in 2010. Taxable income computations for the members include the following. None of the group members incurred any capital gain or loss transactions during these years, nor did they make any charitable contributions.  How should the 2012 consolidated net operating loss be apportioned among the group members?

How should the 2012 consolidated net operating loss be apportioned among the group members?

ParentCo SubOne SubTwo

A) $60,000 $ 0 $ 0

B) $20,000 $20,000 $20,000

C) $ 0 $20,000 $40,000

D) $ 0 $40,000 $20,000

Correct Answer:

Verified

Correct Answer:

Verified

Q6: When a member departs a consolidated group,it

Q24: A Federal consolidated group can claim a

Q98: List three "intercompany transactions" of a Federal

Q100: How must the IRS collect the liability

Q102: ParentCo's controlled group includes the following members.

Q102: When the parent acquires 51% of a

Q108: ParentCo and SubCo had the following items

Q109: In computing consolidated taxable income, the purchase

Q110: ParentCo and SubCo had the following items

Q125: ParentCo owned 100% of SubCo for the