Multiple Choice

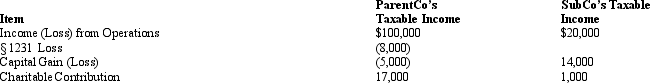

ParentCo and SubCo had the following items of income and deduction for the current year.  Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

Compute ParentCo and SubCo's taxable income or loss computed on a separate basis.

ParentCo SubCo

A) $82,800 $33,000

B) $78,300 $30,600

C) $80,000 $33,000

D) $81,000 $33,000

E) $82,800 $30,600

Correct Answer:

Verified

Correct Answer:

Verified

Q6: When a member departs a consolidated group,it

Q14: When a corporate group elects to file

Q24: A Federal consolidated group can claim a

Q102: When the parent acquires 51% of a

Q105: ParentCo, SubOne and SubTwo have filed consolidated

Q109: In computing consolidated taxable income, the purchase

Q110: ParentCo and SubCo had the following items

Q114: Consolidated group members each must use the

Q125: ParentCo owned 100% of SubCo for the

Q134: If subsidiary stock is redeemed or sold