Multiple Choice

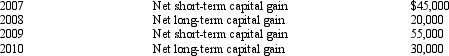

Bear Corporation has a net short-term capital gain of $35,000 and a net long-term capital loss of $200,000 during 2011. Bear Corporation has taxable income from other sources of $600,000. Prior years' transactions included the following:  Compute the amount of Bear's capital loss carryover to 2012.

Compute the amount of Bear's capital loss carryover to 2012.

A) $0.

B) $60,000.

C) $105,000.

D) $165,000.

E) $200,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q80: What is the purpose of Schedule M-3?

Q92: The corporate marginal tax rates range from

Q93: Shareholders of closely held C corporations frequently

Q94: In the current year, Zircon Corporation donated

Q95: The dividends received deduction may be subject

Q98: Warbler Corporation, an accrual method regular corporation,

Q99: Red Corporation, a C corporation that has

Q101: Rose is a 50% partner in Wren

Q101: Shaw, an architect, is the sole shareholder

Q102: Glen and Michael are equal partners in