Essay

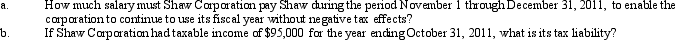

Shaw, an architect, is the sole shareholder of Shaw Corporation, a professional association. The corporation paid Shaw a salary of $255,000 during its fiscal year ending October 31, 2011.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q58: What is the annual required estimated tax

Q80: What is the purpose of Schedule M-3?

Q80: Ed, an individual, incorporates two separate businesses

Q97: Bear Corporation has a net short-term capital

Q98: Warbler Corporation, an accrual method regular corporation,

Q99: Red Corporation, a C corporation that has

Q101: Rose is a 50% partner in Wren

Q102: Glen and Michael are equal partners in

Q103: Grocer Services Corporation (a calendar year taxpayer),

Q104: Thrush Corporation files Form 1120, which reports