Multiple Choice

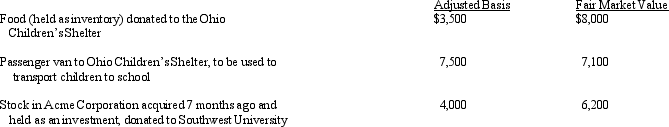

Grocer Services Corporation (a calendar year taxpayer) , a wholesale distributor of food, made the following donations to qualified charitable organizations during the year:  How much qualifies for the charitable contribution deduction?

How much qualifies for the charitable contribution deduction?

A) $15,000.

B) $16,850.

C) $17,250.

D) $19,450.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q58: What is the annual required estimated tax

Q80: What is the purpose of Schedule M-3?

Q80: Ed, an individual, incorporates two separate businesses

Q98: Warbler Corporation, an accrual method regular corporation,

Q99: Red Corporation, a C corporation that has

Q101: Shaw, an architect, is the sole shareholder

Q102: Glen and Michael are equal partners in

Q104: Thrush Corporation files Form 1120, which reports

Q107: Beige Company has approximately $250,000 in net

Q108: Albatross, a C corporation, had $125,000 net