Multiple Choice

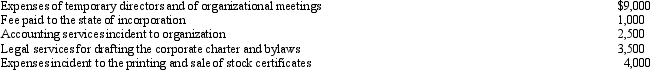

Emerald Corporation, a calendar year C corporation, was formed and began operations on July 1, 2011. The following expenses were incurred during the first tax year (July 1 through December 31, 2011) of operations:  Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2011?

Assuming a § 248 election, what is the Emerald's deduction for organizational expenditures for 2011?

A) $0.

B) $533.

C) $5,367.

D) $5,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Canary Corporation, which sustained a $5,000 net

Q64: Almond Corporation, a calendar year C corporation,

Q65: Generally, corporations with no taxable income must

Q66: Canary Corporation, an accrual method C corporation,

Q67: Ivory Corporation, a calendar year, accrual method

Q70: In 2011, Bluebird Corporation had net income

Q71: Norma formed Hyacinth Enterprises, a proprietorship, in

Q72: Heron Corporation, a calendar year, accrual basis

Q74: On December 31, 2011, Flamingo, Inc., a

Q92: During the current year, Violet, Inc., a