Essay

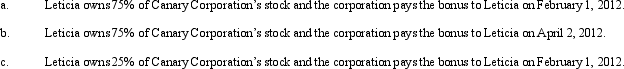

Canary Corporation, an accrual method C corporation, uses the calendar year for tax purposes. Leticia, a cash method taxpayer, is both a shareholder of Canary and the corporation's CFO. On December 31, 2011, Canary has accrued a $100,000 bonus to Leticia. Describe the tax consequences of the bonus to Canary and to Leticia under the following independent situations.

Under § 267(a)(2), an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income. For purposes of this limitation, a more-than-50% shareholder of the corporation is a related party.

Under § 267(a)(2), an accrual method taxpayer must defer a deduction for an expenditure attributable to a cash method related party until such time the related party reports the amount as income. For purposes of this limitation, a more-than-50% shareholder of the corporation is a related party.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Canary Corporation, which sustained a $5,000 net

Q61: On December 20, 2011, the directors of

Q63: During 2011, Sparrow Corporation, a calendar year

Q64: Almond Corporation, a calendar year C corporation,

Q65: Generally, corporations with no taxable income must

Q67: Ivory Corporation, a calendar year, accrual method

Q69: Emerald Corporation, a calendar year C corporation,

Q70: In 2011, Bluebird Corporation had net income

Q71: Norma formed Hyacinth Enterprises, a proprietorship, in

Q75: Jade Corporation, a C corporation, had $100,000