Multiple Choice

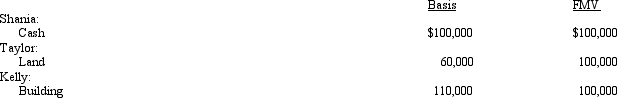

Shania, Taylor, and Kelly form a corporation with the following contributions.

A) If the corporation is a C corporation, Taylor has a recognized gain of $40,000, a stock basis of $100,000, and the corporation has a basis for the land of $100,000.

B) If the corporation is an S corporation, Kelly has a recognized gain or loss of $0, a stock basis of $110,000, and the corporation has a basis for the building of $110,000.

C) If the corporation is a C corporation, Shania has a recognized gain or loss of $0, a stock basis of $100,000, and the corporation has a basis for the cash of $100,000.

D) Only a. and c. are correct.

E) Only b. and c. are correct.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Brenda contributes appreciated property to her business

Q40: If an S corporation distributes appreciated property

Q61: With respect to special allocations, is the

Q64: Eagle, Inc., a C corporation, distributes $250,000

Q67: Kirby, the sole shareholder of Falcon, Inc.,

Q99: What is the major pitfall associated with

Q121: A major benefit of the S corporation

Q129: An effective way for all C corporations

Q150: Which of the following special allocations are

Q165: Robin Company has $100,000 of income before