Essay

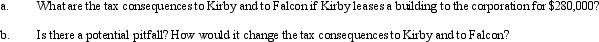

Kirby, the sole shareholder of Falcon, Inc., leases a building to the corporation. The taxable income of the corporation for 2011, before deducting the lease payments, is projected to be $300,000.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Beige, Inc., has 3,000 shares of stock

Q33: Brenda contributes appreciated property to her business

Q40: If an S corporation distributes appreciated property

Q62: Shania, Taylor, and Kelly form a corporation

Q64: Eagle, Inc., a C corporation, distributes $250,000

Q68: Marsha is going to contribute the following

Q69: Mr. and Ms. Smith's partnership owns the

Q71: If the amounts are reasonable, salary payments

Q72: For a limited liability company with 100

Q150: Which of the following special allocations are