Multiple Choice

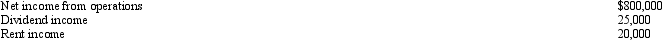

Catfish, Inc., a closely held corporation which is not a PSC, owns a 45% interest in Trout Partnership, which is classified as a passive activity. Trout's taxable loss for the current year is $250,000. During the year, Catfish receives a $60,000 cash distribution from Trout. Other relevant data for Catfish are as follows:  How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

How much of Catfish's share of Trout's loss may it deduct in calculating its taxable income?

A) $0.

B) $20,000.

C) $45,000.

D) $112,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q39: Terry has a 20% ownership interest in

Q40: In its first year of operations, a

Q42: Albert's sole proprietorship owns the following assets:

Q43: Devon owns 40% of the Agate Company

Q45: Which of the following statements regarding the

Q47: Roger owns 40% of the stock of

Q65: How can double taxation be avoided or

Q85: If an individual contributes an appreciated personal

Q110: The tax treatment of S corporation shareholders

Q121: Agnes owns a sole proprietorship for which