Multiple Choice

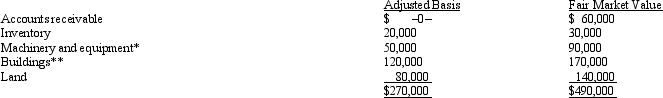

Albert's sole proprietorship owns the following assets:  * Potential § 1245 recapture of $45,000.

* Potential § 1245 recapture of $45,000.

** Straight-line depreciation was used.

Albert sells his sole proprietorship for $500,000. Calculate Albert's recognized gain or loss and classify it as capital or ordinary.

A) $230,000 ordinary income.

B) $230,000 capital gain.

C) $115,000 ordinary income and $115,000 capital gain.

D) $110,000 ordinary income and $120,000 capital gain.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Actual dividends paid to shareholders result in

Q37: A business entity has appreciated land (basis

Q39: Terry has a 20% ownership interest in

Q40: In its first year of operations, a

Q43: Devon owns 40% of the Agate Company

Q44: Catfish, Inc., a closely held corporation which

Q45: Which of the following statements regarding the

Q47: Roger owns 40% of the stock of

Q65: How can double taxation be avoided or

Q121: Agnes owns a sole proprietorship for which