Essay

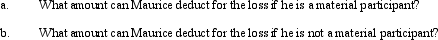

Maurice purchases a bakery from Philip for $410,000. He spends an additional $150,000 (financed with a nonrecourse loan) updating the bakery equipment. During the first year of operations as a sole proprietorship, the bakery incurs a loss of $125,000. Maurice has $300,000 of salary income as the chief financial officer of a publicly-traded corporation. He has interest income of $30,000 and dividend income of $50,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: A limited partnership can indirectly avoid unlimited

Q15: The profits of a business owned by

Q24: Techniques that can be used to minimize

Q45: For a C corporation to be classified

Q83: Of the corporate types of entities, all

Q96: From the perspective of the seller of

Q100: A business entity is not always taxed

Q133: Bart contributes $160,000 to the Tuna Partnership

Q138: Brown, Inc., has accumulated earnings and profits

Q139: Mercedes owns a 40% interest in Teal