Multiple Choice

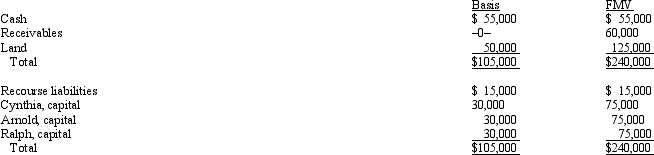

Cynthia sells her 1/3 interest in the CAR Partnership to Brandon for $80,000 cash. Brandon also assumed Cynthia's 1/3 share of partnership liabilities. On the date of sale, the partnership balance sheet and agreed-upon fair market values were as follows:  If the partnership has a § 754 election in effect, the total "step-up" in basis that Brandon can take in the partnership assets is:

If the partnership has a § 754 election in effect, the total "step-up" in basis that Brandon can take in the partnership assets is:

A) $85,000.

B) $55,000.

C) $50,000.

D) $45,000.

E) $20,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Andrew receives a proportionate nonliquidating distribution from

Q61: Which of the following distributions would never

Q65: A property distribution from a partnership to

Q76: In a proportionate nonliquidating distribution of cash

Q79: Your client has operated a sole proprietorship

Q80: Cindy, a 20% general partner in the

Q81: In a liquidating distribution, a partnership need

Q82: In a proportionate liquidating distribution, Scott receives

Q83: The December 31, 2011, balance sheet of

Q122: The RST Partnership makes a proportionate distribution