Essay

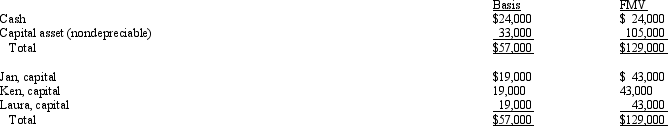

The December 31, 2011, balance sheet of the calendar-year JKL Partnership reads as follows.

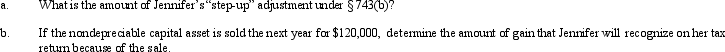

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2011, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2010.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2011, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2010.

Correct Answer:

Verified

Correct Answer:

Verified

Q57: Nicholas is a 25% owner in the

Q78: Cynthia sells her 1/3 interest in the

Q79: Your client has operated a sole proprietorship

Q80: Cindy, a 20% general partner in the

Q81: In a liquidating distribution, a partnership need

Q82: In a proportionate liquidating distribution, Scott receives

Q85: At the beginning of the year, Elsie's

Q86: The Crimson Partnership is a service provider.

Q88: Partner Jordan received a distribution of $80,000

Q101: The MBA Partnership makes a § 736b)