Essay

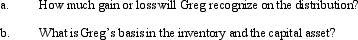

In a proportionate liquidating distribution in which the partnership is liquidated, Greg received cash of $20,000, inventory (basis of $2,000, fair market value of $3,000), and a capital asset (basis and fair market value of $4,000). Immediately before the distribution, Greg's basis in the partnership interest was $30,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q18: In the year a donor gives a

Q57: Nicholas is a 25% owner in the

Q88: Partner Jordan received a distribution of $80,000

Q90: The December 31, 2011, balance sheet of

Q92: For income tax purposes, proportionate and disproportionate

Q92: Normally a distribution of property from a

Q95: Anthony's basis in the WAM Partnership interest

Q96: Hannah sells her 25% interest in the

Q97: A disproportionate distribution occurs when a cash

Q110: Nick sells his 25% interest in the