Essay

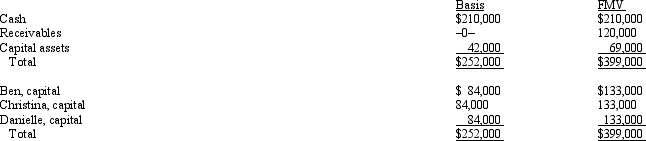

The December 31, 2011, balance sheet of the BCD General Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2011, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. Capital is not a material income-producing factor to the partnership. On December 31, 2011, general partner Christina receives a distribution of $140,000 cash in liquidation of her partnership interest under § 736. Nothing is stated in the partnership agreement about goodwill. Christina's outside basis for the partnership interest immediately before the distribution is $84,000.

How much is Christina's recognized gain from the distribution and what is the character of the gain?

Correct Answer:

Verified

Christina will recognize $47,000 of ordi...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: Jeremy sold his 40% interest in the

Q20: Chelsea owns a 25% capital and profits

Q26: Carlos receives a proportionate liquidating distribution consisting

Q26: On August 31 of the current tax

Q27: Tina sells her 1/3 interest in the

Q28: In a proportionate liquidating distribution, UVW Partnership

Q30: Aaron owns a 30% interest in a

Q85: A partnership is required to make a

Q95: A partnership has accounts receivable with a

Q115: Susan is a one-fourth limited partner in