Essay

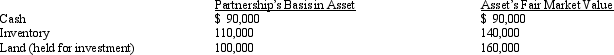

Chelsea owns a 25% capital and profits interest in the calendar-year CJDV Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $170,000. On that date, she receives a proportionate nonliquidating distribution of the following assets:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: Jeremy sold his 40% interest in the

Q15: The JIH Partnership distributed the following assets

Q16: Josh has a 25% capital and profits

Q17: Pat is a 40% member of the

Q19: Which of the following is not true

Q25: Tom and Terry are equal owners in

Q25: The December 31, 2011, balance sheet of

Q26: Carlos receives a proportionate liquidating distribution consisting

Q85: A partnership is required to make a

Q95: A partnership has accounts receivable with a