Essay

On January 1, 2014, Wrobel Company acquired a 90 percent interest in Sally Company for $270,000. On January 1, 2014, Sally's total stockholders' equity was $300,000. The fair value and book value of Sally's individual assets and liabilities were equal.

On January 2, 2014, Sally Company acquired a 10 percent interest in Wrobel Company for $70,000. On January 2, 2014, Wrobel's total stockholders' equity was $700,000. The fair value and book value of Wrobel's individual assets and liabilities were equal.

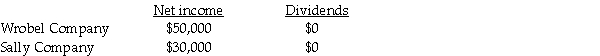

For the year ending December 31, 2014, the following data is available:

The treasury stock method is used to account for the mutual stock holdings between Wrobel and Sally. The separate net incomes do not include investment income.

The treasury stock method is used to account for the mutual stock holdings between Wrobel and Sally. The separate net incomes do not include investment income.

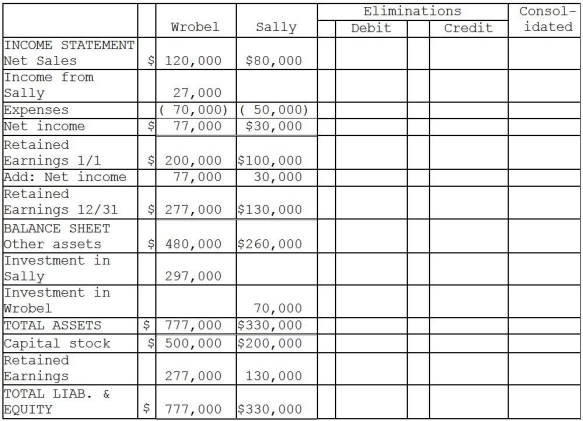

A partial working paper is available for the year ending December 31, 2014.

Required:

Required:

Prepare the elimination entries for the year ending December 31, 2014.

Do not enter them onto the worksheet. Instead, list them below.

Correct Answer:

Verified

Correct Answer:

Verified

Q3: On January 1, 2014, Paul Corporation acquired

Q4: Pablo Corporation acquired 60% of Abagia Corporation

Q6: On January 1, 2014, Klode Corporation acquired

Q9: Use the following information to answer the

Q9: On January 1, 2014, Singh Company acquired

Q11: Paine Corporation owns 90% of Achan Corporation,Achan

Q24: Use the following information to answer

Q28: Use the following information to answer the

Q37: Use the following information to answer the

Q39: Use the following information to answer the