Essay

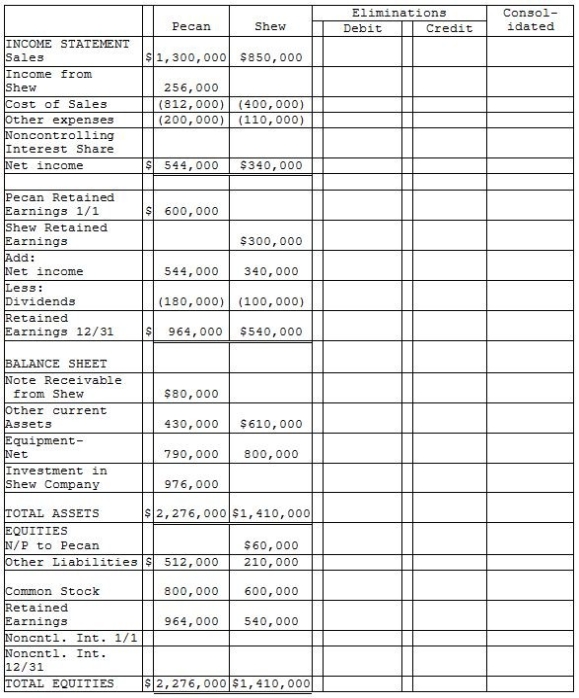

Pecan Incorporated acquired 80% of the voting stock of Shew Manufacturing for $800,000 on January 2, 2014 when Shew had outstanding common stock of $600,000 and Retained Earnings of $300,000. The book value and fair value of Shew's assets and liabilities were equal except for equipment. The entire fair value/book value differential is allocated to equipment and is fully depreciated on a straight-line basis over a 5-year period.

During 2014, Shew borrowed $80,000 on a short-term non-interest-bearing note from Pecan, and on December 31, 2014, Shew mailed a check for $20,000 to Pecan in partial payment of the note. Pecan deposited the check on January 4, 2015, and recorded the entry to reduce the note balance at that time.

Required:

Complete the consolidation working papers for the year ended December 31, 2014.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: When performing a consolidation,if the balance sheet

Q5: Use the following information to answer question(s)

Q6: On consolidated working papers,a subsidiary's net income

Q16: In contrast with single entity organizations,consolidated financial

Q26: On January 2,2014,PBL Enterprises purchased 90% of

Q30: On January 2, 2014, Paleon Packaging purchased

Q32: Pull Incorporated and Shove Company reported summarized

Q35: On January 1, 2014, Paisley Incorporated paid

Q38: Parrot Corporation acquired 90% of Swallow Co.

Q44: Which one of the following will increase