Essay

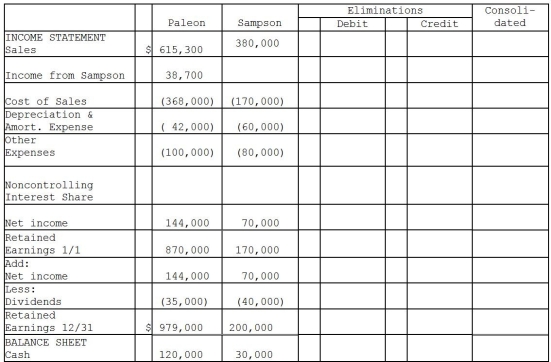

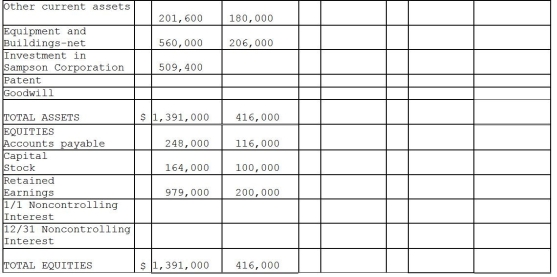

On January 2, 2014, Paleon Packaging purchased 90% of the outstanding common stock of Sampson Shipping and Supplies for $513,000. Sampson's book values represented the fair values of all recorded assets and liabilities at that date, however Sampson had rights to a patent that was not recorded on their books, with an approximate fair value of $270,000, and a 10-year remaining useful life. Sampson's shareholders' equity reported on that date consisted of $100,000 in capital stock and $150,000 in retained earnings. Any remaining fair value/book value differential is assumed to be goodwill. The December 31, 2015 financial statements for each of the companies are provided in the worksheet below.

Required: Complete the consolidation worksheet provided below to determine consolidated balances to be reported at December 31, 2015.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: When performing a consolidation,if the balance sheet

Q5: Use the following information to answer question(s)

Q9: Use the following information to answer question(s)

Q25: Use the following information to answer question(s)

Q25: Bird Corporation has several subsidiaries that are

Q26: On January 2,2014,PBL Enterprises purchased 90% of

Q32: Pull Incorporated and Shove Company reported summarized

Q34: Pecan Incorporated acquired 80% of the voting

Q35: On January 1, 2014, Paisley Incorporated paid

Q44: Which one of the following will increase