Essay

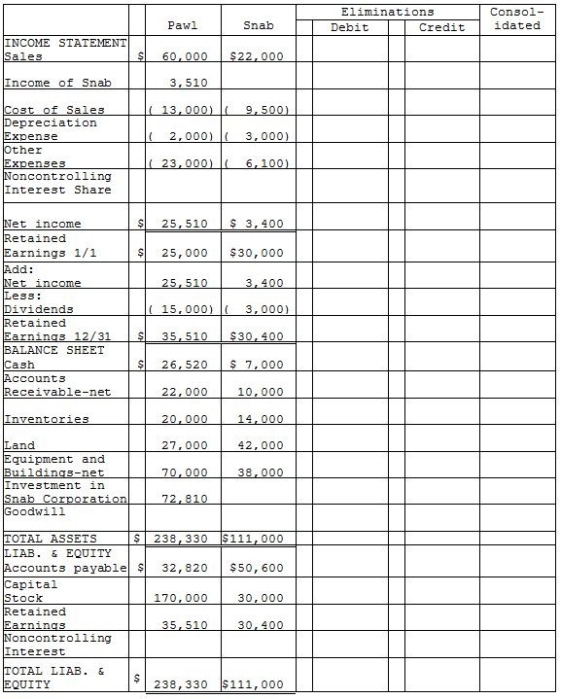

Pawl Corporation acquired 90% of Snab Corporation on January 1, 2014 for $72,000 cash when Snab's stockholders' equity consisted of $30,000 of Capital Stock and $30,000 of Retained Earnings. The difference between the fair value of Pawl's assets and liabilities and the book value was allocated to a plant asset with a remaining 10-year straight-line life that was overvalued on the books by $5,000. The remainder was attributable to goodwill. The separate company statements for Pawl and Snab appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidation working papers for Pawl and Snab for the year 2014.

Correct Answer:

Verified

Preliminar...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: On January 1, 2014, Persona Company acquired

Q3: Pommu Corporation paid $78,000 for a 60%

Q6: Pennack Corporation purchased 75% of the outstanding

Q7: Use the following information to answer question(s)

Q7: Packo Company acquired all the voting stock

Q10: Platt Corporation paid $87,500 for a 70%

Q11: At the beginning of 2014,Parling Food Services

Q38: When preparing the consolidation workpaper for a

Q42: A parent company uses the equity method

Q48: When preparing consolidated financial statements,which of the