Essay

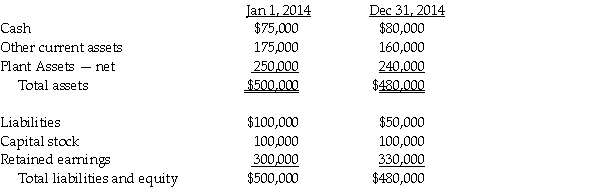

Pennack Corporation purchased 75% of the outstanding stock of Shing Corporation on January 1, 2014 for $300,000 cash. At the time of the purchase, the book value and fair value of Shing's assets and liabilities were equal. Shing's balance sheet at the time of acquisition and December 31, 2014 are shown below.

Shing earned $60,000 in income during the year, and paid out $30,000 in dividends. Pennack uses the equity method to account for its investment in Shing.

Shing earned $60,000 in income during the year, and paid out $30,000 in dividends. Pennack uses the equity method to account for its investment in Shing.

Requirement 1: Calculate Pennack's net income from Shing in 2014.

Requirement 2: Calculate the noncontrolling interest share in Shing's income for 2014.

Requirement 3: Calculate the balance in the Investment in Shing account reported on Pennack's separate general ledger at December 31, 2014.

Requirement 4: Calculate the noncontrolling interest that will be reported on the consolidated balance sheet at December 31, 2014.

Correct Answer:

Verified

Requirement 1: Shing's net income of $60...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q2: On January 1, 2014, Persona Company acquired

Q3: Pommu Corporation paid $78,000 for a 60%

Q4: Pawl Corporation acquired 90% of Snab Corporation

Q7: Use the following information to answer question(s)

Q7: Packo Company acquired all the voting stock

Q10: Platt Corporation paid $87,500 for a 70%

Q11: At the beginning of 2014,Parling Food Services

Q38: When preparing the consolidation workpaper for a

Q42: A parent company uses the equity method

Q48: When preparing consolidated financial statements,which of the