Essay

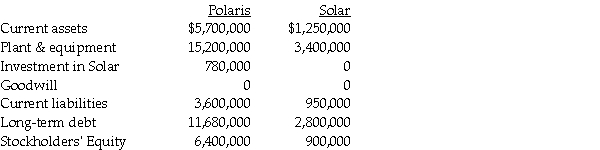

Polaris Incorporated purchased 80% of The Solar Company on January 2, 2014, when Solar's book value was $800,000. Polaris paid $700,000 for their acquisition, and the fair value of noncontrolling interest was $175,000. At the date of acquisition, the fair value and book value of Solar's identifiable assets and liabilities were equal. At the end of the year, the separate companies reported the following balances:

Requirement 1: Calculate consolidated balances for each of the accounts as of December 31, 2014.

Requirement 1: Calculate consolidated balances for each of the accounts as of December 31, 2014.

Requirement 2: Assuming that Solar has paid no dividends during the year, what is the ending balance of the noncontrolling interest in the subsidiary?

Correct Answer:

Verified

Requirement 1:

Current Assets = $5,700,0...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Current Assets = $5,700,0...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: In the preparation of consolidated financial statements,which

Q5: Pinata Corporation acquired an 80% interest in

Q6: On January 1, 2014, Packaging International purchased

Q7: Which method must be used if FASB

Q8: Pool Industries paid $540,000 to purchase 75%

Q10: Petra Corporation paid $500,000 for 80% of

Q12: The consolidated balance sheet of Pasker Corporation

Q35: The unamortized excess account is<br>A)a contra-equity account.<br>B)used

Q37: Percy Inc.acquired 80% of the outstanding stock

Q39: Pomograte Corporation bought 75% of Sycamore Company's