Multiple Choice

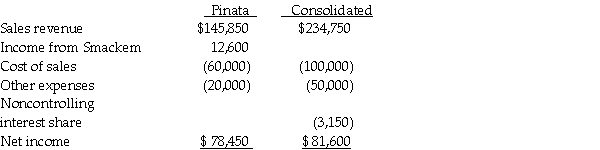

Pinata Corporation acquired an 80% interest in Smackem Inc. for $130,000 on January 1, 2014, when Smackem had Capital Stock of $125,000 and Retained Earnings of $25,000. Assume the fair value and book value of Smackem's net assets were equal on January 1, 2014. Pinata's separate income statement and a consolidated income statement for Pinata and Subsidiary as of December 31, 2014, are shown below.  Smackem's separate income statement must have reported net income of

Smackem's separate income statement must have reported net income of

A) $13,750.

B) $14,750.

C) $15,750.

D) $15,250.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: Pool Industries paid $540,000 to purchase 75%

Q2: Pal Corporation paid $5,000 for a 60%

Q6: On January 1, 2014, Packaging International purchased

Q7: Which method must be used if FASB

Q8: Pool Industries paid $540,000 to purchase 75%

Q9: Polaris Incorporated purchased 80% of The Solar

Q10: Petra Corporation paid $500,000 for 80% of

Q16: A newly acquired subsidiary had pre-existing goodwill

Q37: Percy Inc.acquired 80% of the outstanding stock

Q39: Pomograte Corporation bought 75% of Sycamore Company's