Essay

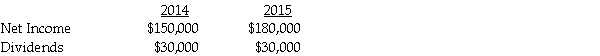

Patterson Company acquired 90% of Starr Corporation on January 1, 2014 for $2,250,000. Starr had net assets at that time with a fair value of $2,500,000. At the time of the acquisition, Patterson computed the annual excess fair-value amortization to be $20,000, based on the difference between Starr's net book value and net fair value. Assume the fair value exceeds the book value, and $20,000 pertains to the whole company. Separate from any earnings from Starr, Patterson reported net income in 2014 and 2015 of $550,000 and $575,000, respectively. Starr reported the following net income and dividend payments:

Required: Calculate the following:

Required: Calculate the following:

• Investment in Starr shown on Patterson's ledger at December 31, 2014 and 2015.

• Investment in Starr shown on the consolidated statements at December 31, 2014 and 2015.

• Consolidated net income for 2014 and 2015.

• Noncontrolling interest balance on Patterson's ledger at December 31, 2014 and 2015.

• Noncontrolling interest balance on the consolidated statements at December 31, 2014 and 2015.

Correct Answer:

Verified

Investment in Starr on Patterson's ledge...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Panini Corporation owns 85% of the outstanding

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q19: Push-down accounting<br>A)requires a subsidiary to use the

Q23: On July 1, 2014, Piper Corporation issued

Q24: Pamula Corporation paid $279,000 for 90% of

Q26: On January 1, 2014, Myna Corporation issued

Q29: From the standpoint of accounting theory,which of

Q29: On January 2, 2014, Power Incorporated paid

Q31: Pattalle Co purchases Senday, Inc. on January

Q48: On June 1,2014,Puell Company acquired 100% of