Essay

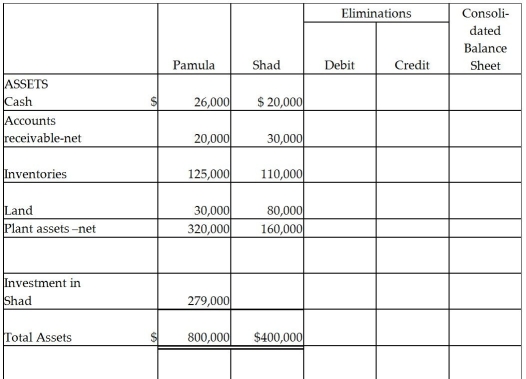

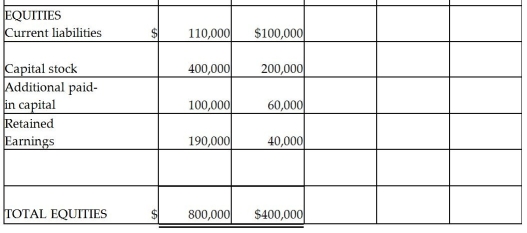

Pamula Corporation paid $279,000 for 90% of Shad Corporation's $10 par common stock on December 31, 2014, when Shad Corporation's stockholders' equity was made up of $200,000 of Common Stock, $60,000 Additional Paid-in Capital and $40,000 of Retained Earnings. Shad's identifiable assets and liabilities reflected their fair values on December 31, 2014, except for Shad's inventory which was undervalued by $5,000 and their land which was undervalued by $2,000. Balance sheets for Pamula and Shad immediately after the business combination are presented in the partially completed working papers.

Required:

Required:

Complete the consolidated balance sheet working papers for Pamula Corporation and Subsidiary.

Correct Answer:

Verified

Preliminar...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: A subsidiary can be excluded from consolidation

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q20: Parrot Inc. acquired an 85% interest in

Q21: On January 1, 2014, Parry Incorporated paid

Q23: On July 1, 2014, Piper Corporation issued

Q26: On January 1, 2014, Myna Corporation issued

Q27: Patterson Company acquired 90% of Starr Corporation

Q29: From the standpoint of accounting theory,which of

Q29: On January 2, 2014, Power Incorporated paid

Q48: On June 1,2014,Puell Company acquired 100% of