Essay

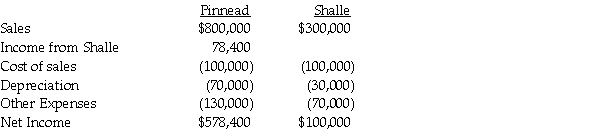

On January 1, 2014, Pinnead Incorporated paid $300,000 for an 80% interest in Shalle Company. At that time, Shalle's total book value was $300,000. Patents were undervalued in the amount of $10,000. Patents had a 5-year remaining useful life, and any remaining excess value was attributed to goodwill. The income statements for the year ended December 31, 2014 of Pinnead and Shalle are summarized below:

Requirements:

Requirements:

1. Calculate the goodwill that will appear in the consolidated balance sheet of Pinnead and Subsidiary at December 31, 2014.

2. Calculate consolidated net income for 2014.

3. Calculate the noncontrolling interest share for 2014.

Correct Answer:

Verified

Requiremen...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: In the preparation of consolidated financial statements,which

Q3: On July 1,2014,when Salaby Company's total stockholders'

Q3: A subsidiary can be excluded from consolidation

Q10: Petra Corporation paid $500,000 for 80% of

Q12: The consolidated balance sheet of Pasker Corporation

Q16: Passcode Incorporated acquired 90% of Safe Systems

Q20: Parrot Inc. acquired an 85% interest in

Q31: Pental Corporation bought 90% of Sedacor Company's

Q35: The unamortized excess account is<br>A)a contra-equity account.<br>B)used

Q37: Percy Inc.acquired 80% of the outstanding stock