Essay

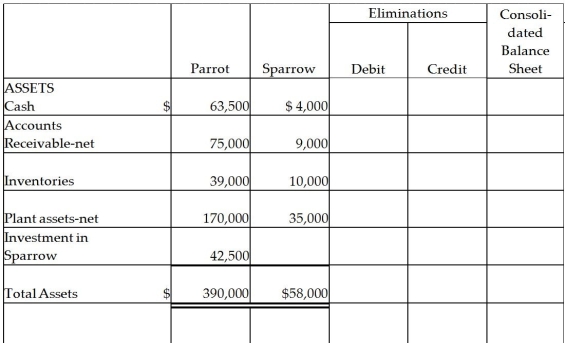

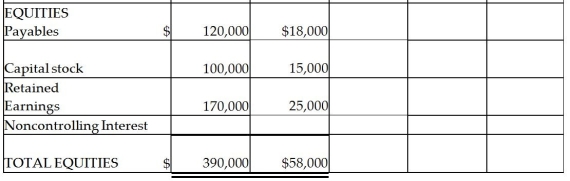

Parrot Inc. acquired an 85% interest in Sparrow Corporation on January 2, 2014 for $42,500 cash when Sparrow had Capital Stock of $15,000 and Retained Earnings of $25,000. Sparrow's assets and liabilities had book values equal to their fair values except for inventory that was undervalued by $2,000. Balance sheets for Parrot and Sparrow on January 2, 2014, immediately after the business combination, are presented in the first two columns of the consolidated balance sheet working papers.

Required:

Required:

Complete the consolidation balance sheet working papers for Parrot and subsidiary at January 1, 2014.

Correct Answer:

Verified

Preliminar...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q3: A subsidiary can be excluded from consolidation

Q3: On July 1,2014,when Salaby Company's total stockholders'

Q15: On January 1, 2014, Pinnead Incorporated paid

Q16: Passcode Incorporated acquired 90% of Safe Systems

Q18: Pregler Inc.has 70% ownership of Sach Company,but

Q21: On January 1, 2014, Parry Incorporated paid

Q23: On July 1, 2014, Piper Corporation issued

Q24: Pamula Corporation paid $279,000 for 90% of

Q31: Pental Corporation bought 90% of Sedacor Company's

Q48: On June 1,2014,Puell Company acquired 100% of