Essay

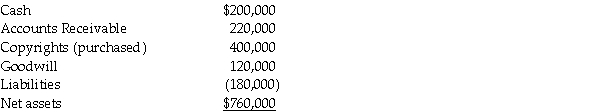

On January 2, 2013, Pilates Inc. paid $900,000 for all of the outstanding common stock of Spinning Company, and dissolved Spinning Company. The carrying values for Spinning Company's assets and liabilities are recorded below.

On January 2, 2013, Spinning anticipated collecting $185,000 of the recorded Accounts Receivable. Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own, and also unrecorded patents with a fair value of $100,000.

On January 2, 2013, Spinning anticipated collecting $185,000 of the recorded Accounts Receivable. Pilates entered into the acquisition because Spinning had Copyrights that Pilates wished to own, and also unrecorded patents with a fair value of $100,000.

Required:

Calculate the amount of goodwill that will be reported on Pilate's balance sheet as of the date of acquisition.

Correct Answer:

Verified

Goodwill is calculated as foll...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: In reference to international accounting for goodwill,U.S.companies

Q19: On December 31, 2013, Peris Company acquired

Q24: At December 31, 2013, Pandora Incorporated issued

Q25: On June 30, 2013, Stampol Company ceased

Q27: In reference to the FASB disclosure requirements

Q27: Bigga Corporation purchased the net assets of

Q28: Which of the following is not a

Q30: Pitch Co.paid $50,000 in fees to its

Q34: Use the following information to answer

Q45: Under the current GAAP,Goodwill arising from a