Essay

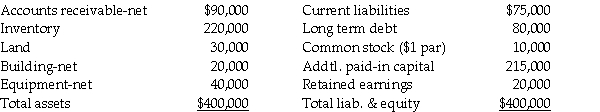

Bigga Corporation purchased the net assets of Petit, Inc. on January 2, 2013 for $380,000 cash and also paid $15,000 in direct acquisition costs. Petit, Inc. was dissolved on the date of the acquisition. Petit's balance sheet on January 2, 2013 was as follows:

Fair values agree with book values except for inventory, land, and equipment, which have fair values of $260,000, $35,000 and $35,000, respectively. Petit has patent rights with a fair value of $20,000.

Fair values agree with book values except for inventory, land, and equipment, which have fair values of $260,000, $35,000 and $35,000, respectively. Petit has patent rights with a fair value of $20,000.

Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

Correct Answer:

Verified

General journal entr...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Picasso Co.issued 5,000 shares of its $1

Q22: On January 2, 2013, Pilates Inc. paid

Q22: Following the accounting concept of a business

Q24: At December 31, 2013, Pandora Incorporated issued

Q25: On June 30, 2013, Stampol Company ceased

Q27: In reference to the FASB disclosure requirements

Q30: Pali Corporation exchanges 200,000 shares of newly

Q32: On January 2, 2013 Carolina Clothing issued

Q34: Use the following information to answer

Q37: A business merger differs from a business