Multiple Choice

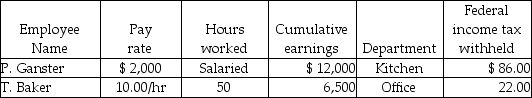

Grammy's Bakery had the following information for the pay period ending June 30:  Assume:

Assume:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to Office Salaries Expense?

A) Debit $550

B) Credit $550

C) Debit $500

D) Credit $500

Correct Answer:

Verified

Correct Answer:

Verified

Q41: The W-2 is the Wage and Tax

Q42: The following data applies to the

Q44: The journal entry to record the estimated

Q45: Form SS-4 is:<br>A) completed to obtain an

Q48: Prepare a general journal payroll entry for

Q62: Ben's Mentoring had the following information for

Q65: Form 941 taxes include OASDI, Medicare, and

Q92: The following data applies to the July

Q103: Prepare the general journal entry to record

Q107: Payroll Cash is a(n):<br>A)revenue.<br>B)liability.<br>C)asset.<br>D)expense.