Essay

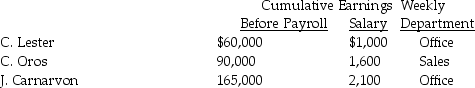

Prepare a general journal payroll entry for Advanced Computer Programming using the following information:

Assume the following:

Assume the following:

a)FICA: OASDI, 6.2% on a limit of $106,800; Medicare, 1.45%

b)Federal income tax is 15% of gross pay

c)Each employee pays $20 per week for medical insurance

Correct Answer:

Verified

Correct Answer:

Verified

Q39: If an employer owes less than $2,500

Q44: The journal entry to record the estimated

Q45: Grammy's Bakery had the following information for

Q45: Form SS-4 is:<br>A) completed to obtain an

Q61: S.Ferrari,an employee of Plum Hollow Country Club,earned

Q62: Ben's Mentoring had the following information for

Q65: Form 941 taxes include OASDI, Medicare, and

Q75: The account for Payroll Tax Expense includes

Q92: The following data applies to the July

Q107: Payroll Cash is a(n):<br>A)revenue.<br>B)liability.<br>C)asset.<br>D)expense.