Essay

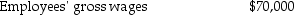

Payroll information for Kinzer's Interior Decorating for the first week in October is as follows:

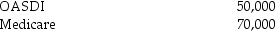

Taxable earnings for FICA-

Taxable earnings for FICA-

Taxable earnings subject to Federal and State Unemployment taxes: $5,000

Taxable earnings subject to Federal and State Unemployment taxes: $5,000

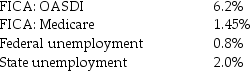

Assume the following tax rates:

Required: Prepare the payroll tax expense entry.

Required: Prepare the payroll tax expense entry.

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Mike's Door Service's payroll data for the

Q25: Grammy's Bakery had the following information for

Q28: Grammy's Bakery had the following information for

Q29: For each of the following, identify in

Q38: The employer's annual Federal Unemployment Tax Return

Q50: The following amounts are an expense to

Q82: The payroll tax expense is recorded at

Q87: Which of the following statements is true?<br>A)Payroll

Q89: The following data applies to the July

Q99: The W-3 is filed along with copies