Multiple Choice

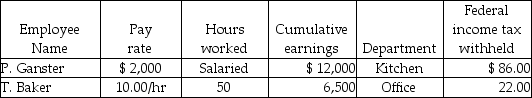

Grammy's Bakery had the following information for the pay period ending June 30:

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-OASDI applied to the first $106,800 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Given the above information, what would be the amount applied to FUTA Payable?

A) Debit $4.00

B) Credit $4.00

C) Debit $20.40

D) Credit $20.40

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Mike's Door Service's payroll data for the

Q27: Payroll information for Kinzer's Interior Decorating for

Q28: Grammy's Bakery had the following information for

Q29: For each of the following, identify in

Q38: The employer's annual Federal Unemployment Tax Return

Q62: A deposit must be made when filing

Q69: When a business starts, what must it

Q82: The payroll tax expense is recorded at

Q89: The following data applies to the July

Q99: The W-3 is filed along with copies