Essay

Tulip Company produces two products, T and U.The indirect labor costs include the following two items:

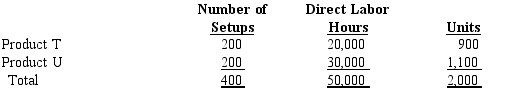

The following activity-base usage and unit production information is available for the two products:

The following activity-base usage and unit production information is available for the two products:

a Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

a Determine the single plantwide factory overhead rate, using direct labor hours as the activity base.

b Determine the factory overhead cost per unit for Products T and U, using the single plantwide factory overhead rate.

c Determine the activity rate for plant supervision and setup labor, assuming that the activity base for supervision is direct labor hours and the activity base for setup labor is number of setups.

d Determine the factory overhead cost per unit for Products T and U, using activity-based costing.

e Why is the factory overhead cost per unit different for the two products under the two methods?

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Using the single plantwide factory overhead rate

Q10: A plantwide factory overhead rate assumes that

Q56: Scoresby Co.uses 6 machine hours and 2

Q58: Determine the overhead from both production departments

Q59: Calculate the cost of services for a

Q60: Using the single plantwide factory overhead rate

Q63: The Pikes Peak Leather Company manufactures leather

Q66: Shubelik Company is changing to an activity-based

Q92: Managers depend on product costing to make

Q102: The total factory overhead for Big Light