Multiple Choice

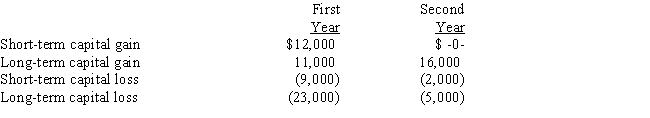

Given below are Mario's capital gains and losses for two consecutive years.What is the effect of the capital gains and losses on Mario's taxable income for each year?

First Second

Year Year

A) $(9,000) $ 9,000

B) $ 3,000 $ 1,000

C) $(3,000) $ 3,000

D) $(3,000) $(3,000)

E) $(3,000) $ -0-

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Nora,a single individual age 60,receives a gold

Q50: Brandon is the operator and owner of

Q51: Helena and Irwin are married taxpayers who

Q54: Ellie has the following capital gains and

Q55: Boomtown Construction,Inc.enters into a contract to build

Q57: Arnold is the President of Conrad Corporation.Arnold

Q69: Anna receives a salary of $42,000 during

Q76: In what circumstances would some portion of

Q142: Under the imputed interest rules, gift loans

Q144: Victoria is an employee of The Bellamy