Multiple Choice

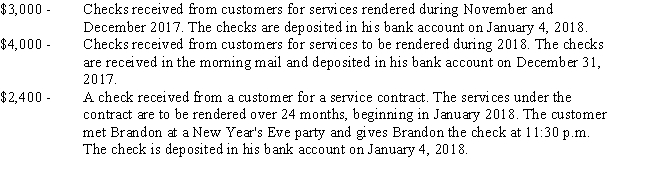

Brandon is the operator and owner of a cleaning service who uses the cash method of accounting.He receives the following payments on December 31,2017,the last business day of his tax year:

How much of the $9,400 collected by Brandon on December 31 must be included in his 2017 gross income?

A) $2,400

B) $3,000

C) $5,400

D) $7,000

E) $9,400

Correct Answer:

Verified

Correct Answer:

Verified

Q47: Nora,a single individual age 60,receives a gold

Q51: Helena and Irwin are married taxpayers who

Q52: Given below are Mario's capital gains and

Q54: Ellie has the following capital gains and

Q55: Boomtown Construction,Inc.enters into a contract to build

Q69: Anna receives a salary of $42,000 during

Q121: James bought an annuity for $42,000 several

Q137: Match each statement with the correct term

Q142: Under the imputed interest rules, gift loans

Q144: Victoria is an employee of The Bellamy