Multiple Choice

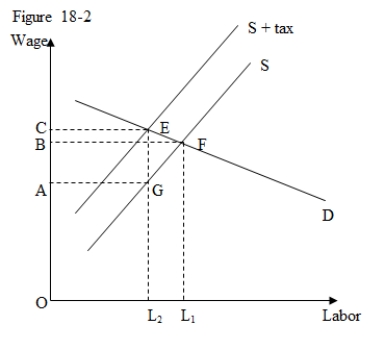

Use the following figure to answer the question : Figure 18-2 :

shows the demand and supply curves of labor.A per-unit tax imposed on the wage income of the employees shifts the supply curve of labor upward.

-In Figure 18-2,as a result of a per-unit tax:

A) the total wage paid by employers rises,while the net-wage received by employees declines.

B) the total wage paid by employers declines,while the net-wage received by the employees rises.

C) the total wage paid by employers declines.

D) the total wage received by employees decline.

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Most of a payroll tax is eventually

Q37: Using a graph,explain the employment effects of

Q38: Which of the following defines an efficiency

Q39: Use the following figure to answer the

Q40: Identify some of the reasons due to

Q42: Employers sometimes reduce the fringe benefits provided

Q43: Which of the following factors determines the

Q44: Provide a self-interested explanation for why labor

Q45: Use the following figure to answer the

Q46: Use the following figure to answer the