Multiple Choice

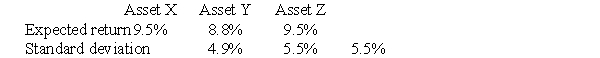

Use the following information,which describes the expected return and standard deviation for three different assets,to answer the following question(s) .

-If an investor must choose between investing in either Asset X or Asset Z,then:

A) he will always choose Asset X over Asset Z.

B) he will always choose Asset Z over Asset X.

C) he will be indifferent between investing in Asset X and Asset Z.

D) none of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The market risk premium is<br>A) 2%.<br>B) 4%.<br>C)

Q20: Provide an intuitive discussion of beta and

Q64: What type of risk can investors reduce

Q66: Your broker mailed you your year-end statement.You

Q67: What would happen if investors became more

Q69: The relevant risk to an investor is

Q73: You are considering a security with the

Q74: You are going to invest all of

Q75: Tanzlin Manufacturing's common stock has a beta

Q102: A stock with a beta greater than