Multiple Choice

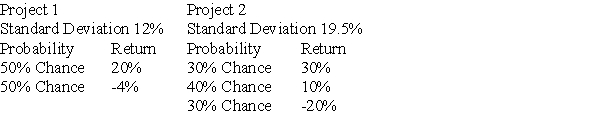

You are going to invest all of your funds in one of three projects with the following distribution of possible returns:

Project 3

Standard Deviation 12%

If you are a risk-averse investor,which one should you choose?

A) Project 1

B) Project 2

C) Project 3

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q5: Your broker mailed you your year-end statement.You

Q20: Provide an intuitive discussion of beta and

Q64: What type of risk can investors reduce

Q69: The relevant risk to an investor is

Q71: Use the following information,which describes the expected

Q73: You are considering a security with the

Q75: Tanzlin Manufacturing's common stock has a beta

Q77: The beta of ABC Co.stock is the

Q77: Which of the following is a good

Q102: A stock with a beta greater than