Multiple Choice

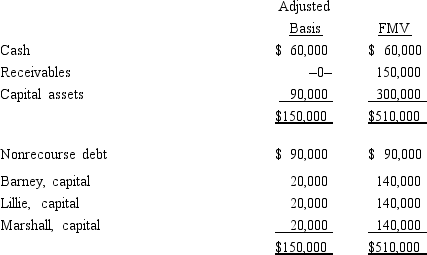

The BLM LLC's balance sheet on August 31 of the current year is as follows.  The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

The nonrecourse debt is shared equally among the LLC members. On that date, Lillie sells her one-third interest to Robyn for $170,000, including cash and relief of Lillie's share of the nonrecourse debt. Lillie's outside basis for her interest in the LLC is $50,000, including her share of the LLC's debt. How much capital gain and/or ordinary income will Lillie recognize on the sale?

A) $100,000 capital gain; $50,000 ordinary income.

B) $120,000 capital gain; $0 ordinary income.

C) $150,000 capital gain; $0 ordinary income.

D) $70,000 capital gain; $50,000 ordinary income.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Frank receives a proportionate nonliquidating distribution from

Q16: Compare the different tax results (gains, losses,

Q27: Match the following statements with the best

Q43: A partnership has accounts receivable with a

Q45: Which of the following statements is true

Q58: Randi owns a 40% interest in the

Q92: Normally a distribution of property from a

Q130: The December 31, 2014, balance sheet of

Q131: Karli owns a 25% capital and profits

Q132: Hannah sells her 25% interest in the