Essay

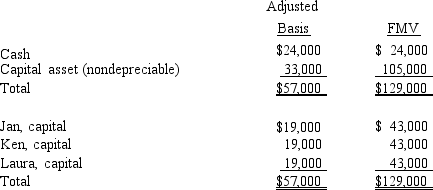

The December 31, 2014, balance sheet of the calendar-year JKL Partnership reads as follows.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2014, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2014.

Each partner shares in 1/3 of the partnership capital, income, gain, loss, deduction and credit. On December 31, 2014, Jan sells her 1/3 partnership interest to Jennifer for $43,000 cash. Assume the partnership makes a § 754 election for 2014.

a. What is the amount of Jennifer's "stepup" adjustment under § 743(b)?

b. If the nondepreciable capital asset is sold the next year for $120,000, determine the amount of gain that Jennifer will recognize on her tax return because of the sale.

Correct Answer:

Verified

y. Jennifer has a § 743(b) stepup adjus...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: Frank receives a proportionate nonliquidating distribution from

Q27: Match the following statements with the best

Q40: Match the following independent distribution payments in

Q43: A partnership has accounts receivable with a

Q45: Which of the following statements is true

Q58: Randi owns a 40% interest in the

Q92: Normally a distribution of property from a

Q129: The BLM LLC's balance sheet on August

Q131: Karli owns a 25% capital and profits

Q132: Hannah sells her 25% interest in the