Multiple Choice

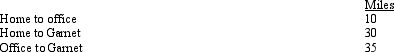

Amy works as an auditor for a large major CPA firm.During the months of September through November of each year, she is permanently assigned to the team auditing Garnet Corporation.As a result, every day she drives from her home to Garnet and returns home after work.Mileage is as follows:  For these three months, Amy's deductible mileage for each workday is:

For these three months, Amy's deductible mileage for each workday is:

A) 0.

B) 30.

C) 35.

D) 60.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: A participant has an adjusted basis of

Q2: A taxpayer who uses the automatic mileage

Q32: Elsie lives and works in Detroit. She

Q102: Qualifying job search expenses are deductible even

Q106: Myra's classification of those who work for

Q110: Which, if any, of the following is

Q111: A statutory employee is not a common

Q113: Every year, Penguin Corporation gives each employee

Q117: For the current year, Horton was employed

Q119: When using the automatic mileage method, which,