Essay

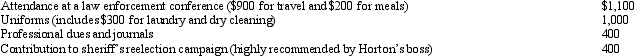

For the current year, Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Correct Answer:

Verified

$1,400.$1,000 + $1,000 + $400 = $2,400 -...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: A participant has an adjusted basis of

Q2: A taxpayer who uses the automatic mileage

Q32: Elsie lives and works in Detroit. She

Q102: Qualifying job search expenses are deductible even

Q106: Myra's classification of those who work for

Q113: Every year, Penguin Corporation gives each employee

Q115: Amy works as an auditor for a

Q119: When using the automatic mileage method, which,

Q121: The Federal per diem rates that can

Q122: In terms of IRS attitude, what do