Multiple Choice

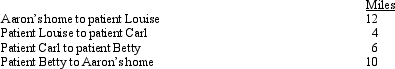

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

A) 10 miles.

B) 12 miles.

C) 20 miles.

D) 22 miles.

E) 32 miles.

Correct Answer:

Verified

Correct Answer:

Verified

Q27: Qualified moving expenses of an employee that

Q85: Jake performs services for Maude. If Jake

Q86: The IRS will not issue advanced rulings

Q87: As Christmas presents, Lily sends gift certificates

Q89: By itself, credit card receipts will constitute

Q91: Arnold is employed as an assistant manager

Q92: Jackson gives his supervisor a $30 box

Q93: Alfredo, a self-employed patent attorney, flew from

Q94: Which, if any, of the following expenses

Q95: As to meeting the time test for