Essay

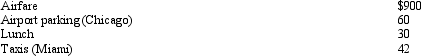

Alfredo, a self-employed patent attorney, flew from his home in Chicago to Miami, had lunch alone at the airport, conducted business in the afternoon, and returned to Chicago in the evening.His expenses were as follows:

What is Alfredo's deductible expense for the trip?

What is Alfredo's deductible expense for the trip?

Correct Answer:

Verified

$1,002 ($900 + $60 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Qualified moving expenses of an employee that

Q89: By itself, credit card receipts will constitute

Q90: Aaron is a self-employed practical nurse who

Q91: Arnold is employed as an assistant manager

Q92: Jackson gives his supervisor a $30 box

Q94: Which, if any, of the following expenses

Q95: As to meeting the time test for

Q96: Statutory employees:<br>A) Report their expenses on Schedule

Q97: If a business retains someone to provide

Q98: Debby is a self-employed accountant with a