Multiple Choice

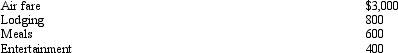

During the year, Peggy went from Nashville to Quito (Ecuador) on business.She spent four days on business, two days on travel, and four days on vacation.Disregarding the vacation costs, Peggy's unreimbursed expenses are:  Peggy's deductible expenses are:

Peggy's deductible expenses are:

A) $2,500.

B) $2,800.

C) $3,100.

D) $4,300.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q5: Joyce, age 39, and Sam, age 40,

Q6: Dave is the regional manager for a

Q7: Which, if any, of the following expenses

Q9: After graduating from college, Clint obtained employment

Q11: Taylor performs services for Jonathan on a

Q14: Ava holds two jobs and attends graduate

Q15: Regarding § 222 (qualified higher education deduction

Q38: When is a taxpayer's work assignment in

Q47: Once set for a year, when might

Q85: If an individual is ineligible to make