Essay

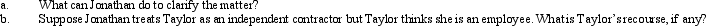

Taylor performs services for Jonathan on a regular basis.There exists considerable doubt as to whether Taylor is an employee or an independent contractor.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q6: Dave is the regional manager for a

Q7: Which, if any, of the following expenses

Q9: After graduating from college, Clint obtained employment

Q10: During the year, Peggy went from Nashville

Q14: Ava holds two jobs and attends graduate

Q15: Regarding § 222 (qualified higher education deduction

Q38: When is a taxpayer's work assignment in

Q47: Once set for a year, when might

Q85: If an individual is ineligible to make

Q89: For tax purposes, travel is a broader