Multiple Choice

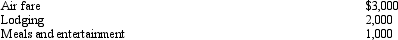

During the year, Oscar travels from Raleigh to Moscow (Russia) on business.His time was spent as follows: 2 days travel (one day each way) , 2 days business, and 2 days personal.His expenses for the trip were as follows (meals and lodging reflect only the business portion) :  Presuming no reimbursement, Oscar's deductible expenses are:

Presuming no reimbursement, Oscar's deductible expenses are:

A) $6,000.

B) $5,500.

C) $4,500.

D) $3,500.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Q11: Employees who render an adequate accounting to

Q54: Tired of renting, Dr.Smith buys the academic

Q55: The maximum annual contribution to a Roth

Q57: Frank, a recently retired FBI agent, pays

Q61: Match the statements that relate to each

Q63: Gwen went to Paris on business.While there,

Q69: Bob lives and works in Newark, NJ.He

Q73: Distributions from a Roth IRA that are

Q123: Nicole just retired as a partner in

Q134: Christopher just purchased an automobile for $40,000